We Don't Bite,

We Build Relationships.

Private Real Estate Loans Built on Support, Trust & Transparency

Find out if we’ll be good together.

Free advice. No obligation.

0

+

Years of Experience

0

+

States Served In

$

0

B+

Transactions Closed By The Management Team

Fast Funding

As a trusted private money lender for real estate, Amplend gets you fast approvals and quick closings so you can beat the market instead of chasing it. We look at the asset and your actual strategy; no endless paperwork, just straightforward funding that keeps you moving.

Flexible Loan Programs

Amplend builds bridge, fix-and-flip, rental, and new construction loans around what you really need as your private money lender for real estate. We shape the terms to match your timeline, exit plan, and growth goals so the financing actually works for you.

No Bank Hassles

Working with Amplend feels straightforward and personal. We cut out the layers and slow bank nonsense that drag deals down. You get quicker decisions, direct conversations, and a partner who actually gets real estate investing.

Local Expertise

We’re a New Jersey-focused private money lender for real estate, and our team knows the market literally block by block. That local insight lets us structure deals that protect your margins and give you the biggest possible upside.

Investor-Focused

We’re in it for the long haul as a private money lender for real estate investors here in New Jersey. You’ll have personalized support, reliable access to capital, and the flexibility to scale confidently without second-guessing every move.

Dedicated Lending Experts

When you team up with Amplend, our lending specialists are right there with you as your private money lender for real estate. They bring real-world investing experience, sharp property analysis, and hands-on guidance so you can make solid, confident calls every step of the way.

Real Estate Ambition Becomes Action

Supporting Real Estate Investors with Funding, Guidance, and Community.

At Amplend, we know that private lending is more than just numbers, it’s about people, trust, and shared success. That’s why we take a relationship-first approach, offering flexible capital solutions and personal support for real estate investors at every stage.

Whether you're buying your first flip, scaling your portfolio, or somewhere in between, we’re here to provide not just funding, but a real connection you can count on.

We don’t just say we support investors, we show up. From our deal process to our community involvement, we’re proud to walk alongside the people building the future of real estate.

Your next investment deserves hassle-free funding

3 Steps to Success

01

Application

Kickstart your funding journey by submitting a quick and easy online application. Share key details about your real estate project, goals, and financing needs, no mountains of paperwork required. The more we know, the better we can tailor a solution just for you.

02

Approval

Once we receive your application, our in-house team gets to work right away. With no bank bureaucracy or unnecessary delays, we review your deal efficiently and keep you updated every step of the way. Our goal is to move quickly and get you one step closer to funding.

03

Funding

Once approved, you'll receive your funding in just a few days, not weeks. We're committed to helping you move quickly so you can focus on closing deals and scaling your investments.

Where We Lend

Amplend Lends In The Following States

Explore our lending footprint, discover diverse regions, and envision real estate possibilities. Amplend is your partner on the path to real estate success.

Services

Our Loan Programs

Fix & Flip Loans

These 12- to 24-month interest-only loans let you fund vetted rehab projects with competitive yields, fast approvals, and dedicated support that keeps everything smooth.

•Perfect for: Renovation projects with quick turnaround

•Loan amounts: $100K – $ 3 M+

•Terms: 12–24 months

Bridge Loans

Provide quick capital for rent-ready properties through short-term financing with steady returns and fully transparent, tailored terms that help you close fast.

•Terms: 12-24 months

•Use for purchases or cash-out refis

•No income verification required

DSCR Rental Loans

Fund long-term cash-flowing rentals with DSCR-based term loans that deliver predictable payouts and complete visibility at every step.

•Loan amounts: $100K – $3M+

•30-year fixed or ARM options

•DSCR as low as 1.0

New Construction Loans

Back experienced developers on teardowns, infills, and subdivisions with tightly managed construction financing that protects your capital and delivers strong returns through open communication.

•Up to 85% LTC (Loan-to-Cost)

•Flexible draws with quick disbursement

•Support from blueprint to CO

Being Your Funding Partner is One Thing.

Helping You Succeed is What Matters Most.

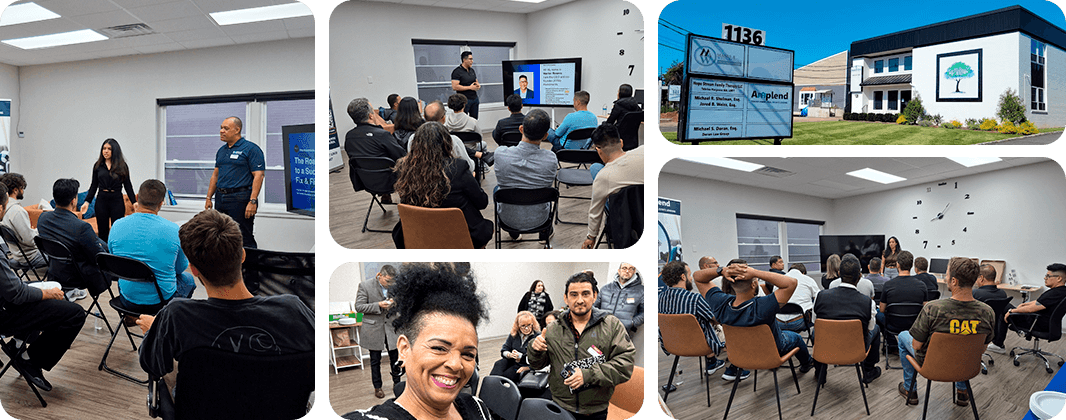

We believe that education and relationships are just as powerful as capital. That’s why we host a Monthly Real Estate Meetup every 3rd Thursday of the month, open to all investors, new or experienced.

These events are packed with insights from seasoned investors, real-life project breakdowns, and networking with people who actually get what you’re doing.

Want to join the next one?

We’d love to have you there. Just RSVP below, it’s 100% free.

How we build relationships

Client Testimonials

Gabriel F. & Blanca C.

Gabriel and Blanca, first-time real estate investors, share how Amplend guided them through funding and mentorship for their first fix-and-flip. Reliable support, fast logistics, and a lasting partnership.

Asim K.

A trusted appraisal partner shares why Amplend stands out in the hard money lending space, transparent, honest, and easy to work with. Tei’s full-disclosure approach sets a new standard for lenders in New Jersey and beyond.

Bryson B.

Real estate investor Bryson shares his experience working with Tei on deals in New Jersey and North Carolina. From smooth funding to reliable communication, Tei and his team make financing fast, easy, and personal.

David A.

Real estate investor David Albas shares how Amplend has helped him scale deals quickly using BRRR and fix-and-flip strategies in Harrisburg, PA. Fast, reliable financing that keeps investors moving.

Knowledge base

Recent Guides on Our Blog

You can read our top quality sectoral guidelines and learn all ins and outs of private lending process. We regularly publish valuable content on our blog to help you reach your financial goals.

EXCELLENTTrustindex verifies that the original source of the review is Google. Amplend ha sido de gran ayuda en nuestro inicio de inversiones.Posted onTrustindex verifies that the original source of the review is Google. Thank you, Amplend, for helping us to get the real estate loans for our properties. Jenny Repko was so supportive of keeping us on track with what we need to do! 100% recommend 👌Posted onTrustindex verifies that the original source of the review is Google. Excelentemente súper bien, confianza al 100 %.Posted onTrustindex verifies that the original source of the review is Google. thank you for your exceptional service and commitment throughout the recent closing process. Your professionalism and dedication truly made a significant difference in ensuring a smooth and successful transaction. I want to express my sincere appreciation for your efforts and for going above and beyond to facilitate a seamless closing. Your expertise and excellent customer service have not gone unnoticed and are genuinely appreciated. I look forward to the opportunity to work with you again in the future.Posted onTrustindex verifies that the original source of the review is Google. I am not one to normally write reviews, but in this case it is more than warranted, after working with other lenders I can see the difference is night, and day. So unfortunately most lenders in the space will offer you the stars, and moon, yet fail to deliver. It is a common practice to bait, and switch, or add some sort of hidden fees in the private lending space. So it was refreshing to work with a company that is transparent, and takes commitments seriously. They offer fast funding, and their team is diligent in their efforts. So normally with this white glove service, you would expect high costs, but they are extremely competitive cost-wise. Their team goes above, and beyond to assist in moving the deal forward. We have closed, various deals with them, and at each one their team has been more then helpful, in routinely following up with all stakeholders, providing advice and resolving any issues. We have a few more deals in the pipeline, and surprisingly their level of customer service has actually improve, which is shocking given the aforementioned. So normally I would not think of a vendor as a partner, but Tei, and his team at Amplend, have been an instrumental partner in scaling our investment business. They are the first call we make once we lock up a deal. We hope to have the privilege to continue to partner with them, as we scale up our business.Posted onTrustindex verifies that the original source of the review is Google. Very transparent during the lending process for real estate investors. Good communication, quick approval, easy to work with.Posted onTrustindex verifies that the original source of the review is Google. Excellent service, 5-star satisfaction. Tei was able to help me to buy my Miami condo. These guys are not expensive, and very transparent with their fees. Strongly recommended. Canadian snowbirds can use Amplend for their US homes.

Partner with us to grow your real estate portfolio

We don’t settle for just your real estate lender. But rather, we pledge to serve as a trustworthy part of your cohesive team so you can solely focus on your project with peace of mind about financing. We will stand by you every step of the way to help you achieve your investment goals.