Mortgage loans secured by real property can be categorized into two types: recourse and non-recourse. Should a borrower default, the lender of a recourse loan has the right to seize other assets of the borrower to satisfy the loan balance if the property’s value does not do so. Lenders of non-recourse loans can only confiscate the collateral securing the debt regardless of any deficiency.

The legal definition of recourse is “the right to demand payment or compensation.” Therefore, given the above, “recourse” and “non-recourse” refer to the borrower’s other assets, not the collateral. The lender can seize the property that secures a recourse and a non-recourse loan.

This article will explain the differences and give examples of each loan structure.

Key Takeaways

- Recourse loans are common when the collateral is residential property

- Non-recourse loans are more common in commercial transactions when other properties within a portfolio are cross-defaulted

- The main difference between recourse and non-recourse loans is the borrower’s personal exposure to risk should there be a default

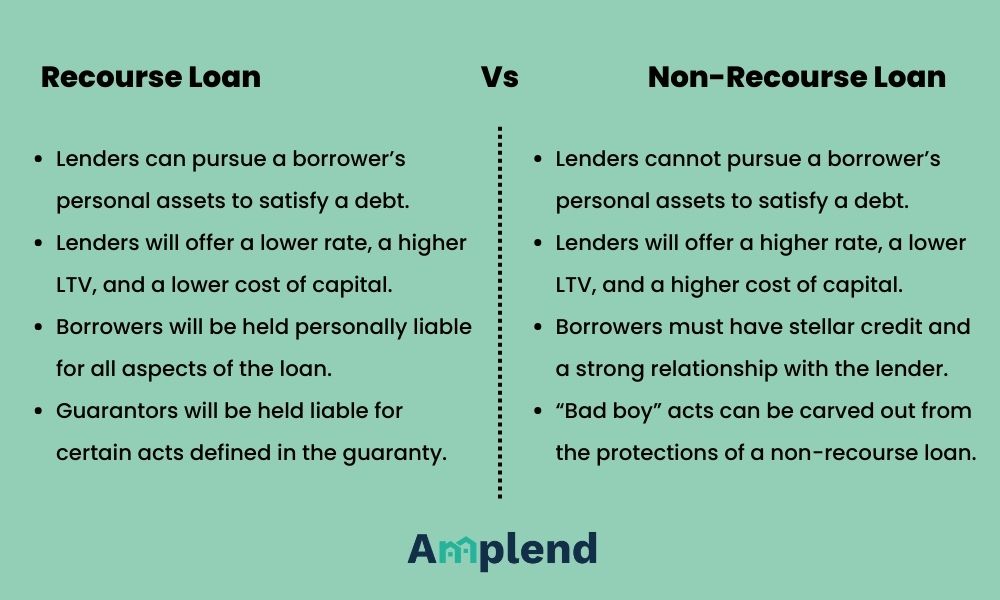

- All things equal, recourse loans offer a lower interest rate, a lower cost of capital, and a higher LTV ratio

- Non-recourse loans generally offer a higher interest rate, a higher cost of capital, and a lower LTV ratio

- The IRS recognizes a deficiency from a defaulted non-recourse loan as a capital gain realized by the borrower

Defined Terms

- Bad Boy Carve-Outs – the acts of misconduct that are carved out from the personal protections of a non-recourse loan

- Recourse – the right to demand payment or compensation

Recourse Loans

Lenders of recourse loans want the assurance of being made whole after a foreclosure or other liquidation of the collateral. Recourse loans are common when secured by residential property. The home can be either the owner’s primary residence or an investment property.

A mortgage loan on an investment property, when the borrower is a single-asset LLC, will require the ability to seize other assets of the individual manager members through a personal guaranty. Without the personal guaranty, the lender would be limited to the asset of the LLC to satisfy the loan.

Because of the lender’s additional security interest in other assets of a borrower, lenders of recourse loans will offer a lower interest rate and a higher loan-to-value (LTV) ratio. However, the downside for a borrower is the lender’s ability to confiscate other assets even with the protections of an LLC structure.

Traditional lenders of mortgage loans mostly offer recourse loans on residential property. These regulated lenders must lend under the least risky structure and must comply with the requirements of Fannie Mae and Freddie Mac.

Example of a Recourse Loan

An everyday example of a recourse loan is a car loan. When a borrower defaults, the lender can seize the car and any other asset of the borrower to pay the total amount due. Unfortunately, because of a car’s accelerated depreciation, there is almost always a deficiency between the loan balance and the car’s market value.

Lenders of recourse mortgage loans can seize the property securing the loan, but real estate appreciates over time. The timing of market appreciation plays a role in a lender’s timing of a foreclosure action, as does the property’s condition. A lender wants to act expeditiously to prevent deterioration from the lack of upkeep and be in the best position to take advantage of the highest market value.

While the lender can be granted a deficiency judgment for the remaining balance after a foreclosure, it is the lender’s discretion to act upon the judgment for collection. The perfected judgment will remain on the borrower’s credit record until satisfied.

A borrower under a recourse loan is personally responsible for the loan payment and any misrepresentation, fraud, and other dishonest acts in connection with the loan.

Non-Recourse Loans

Lenders of non-recourse loans do not have the right to confiscate a borrower’s personal assets should the collateralized property’s value be insufficient to satisfy the loan balance. Non-recourse loans are common in commercial real estate transactions when assets can be cross-defaulted. These loans do not require the borrower to be personally liable, but other properties within a portfolio can be used as additional collateral.

Because of the lender’s inability to pursue other assets of the borrower, non-recourse loans tend to have a higher interest rate, a lower LTV ratio, and a higher cost of capital.

The term “non-recourse” means the borrower’s personal assets are protected from seizure, but not other properties used to secure a loan.

The “Bad Boy” Carve-Outs

Let’s be clear—non-recourse loans are not a borrower’s “get-out-of-jail-free” card. While a borrower cannot be held personally responsible for the debt, a borrower will be held personally liable for fraud, misrepresentation, or breach of environmental protections given to the lender. These acts are known as the “bad boy carve-outs.”

If a borrower acts in bad faith and causes harm or damage to a lender’s position, then the personal protections of non-recourse loans become null and void. The borrower then becomes personally liable for the loan and any additional damages suffered by the lender.

Example of a Non-Recourse Loan

Let’s say that a lender extends to an investor a non-recourse loan collateralized by a residential investment property. The lender has a long and solid relationship with the investor, and the investor has stellar credit and high liquidity within their holdings.

This non-recourse loan will be collateralized by the investment property after the renovations are complete. The projected value is created, and the property is stable. The investor accepts the higher interest rate, the lower LTV, and the higher cost of capital in exchange for not being personally liable for the loan.

The loan document package will contain the guarantee for the “bad boy” clauses. The borrower will become personally liable for any misconduct or loss of the collateral.

Should the borrower default for any reason, as long as none of the “bad boy” carve-outs have been violated, the lender can only look to the asset’s value and the generated cash flow to satisfy the loan.

However, even when the carve-outs do not come into play, there are consequences for a defaulted borrower of a non-recourse loan. Any deficiency amount will go against the borrower’s credit rating, and the IRS views the uncollected deficiency as a gain and will be taxed accordingly. These consequences are in addition to the loss of the property.

Recap of Recourse and Non-Recourse Loans

The main difference between recourse and nonrecourse loans is a borrower’s exposure level at the time of default.

In a recourse loan, an individual borrower will be liable for the repayment of the loan and any acts of misconduct defined in the loan agreement. A guarantor is responsible only for certain acts defined in the guaranty, which are in addition to those of the borrower. There are no carve-outs of a borrower’s liability in a recourse loan.

In a non-recourse loan, a borrower and a guarantor are protected from legal action by the lender to collect a deficiency. However, there will be personal liability for any acts of misconduct that are “carved out” of the non-recourse protections. The individual members, partners, or shareholders will guarantee the carve-outs in loans where the borrower is an entity.

Should a non-recourse loan come into default, a lender must accept any redirected cash flow and the proceeds in a foreclosure sale as the full satisfaction of the loan. However, the lender will record the deficiency in the borrower’s credit record and must report the deficiency to the IRS as a gain realized by the borrower.

As an illustration, the differences between a recourse and a non-recourse loan are:

Conclusion

If you are an investor in the unique position to choose between a recourse or a non-recourse loan, this article gives the advantages and disadvantages of each to consider.

Recourse loans come with the risk of personal exposure to the debt but with lower rates and a lower cost of capital. Lenders of recourse loans are willing to lend further into the capital stack.

Non-recourse loans protect the borrower’s exposure to risk, but the price for this protection is a higher rate and a higher cost of capital. Non-recourse lenders will keep the LTV lower to protect their position against risk. The consequences of a deficiency are a tainted credit report and a capital gains tax on the write-off. Both the borrower and the guarantor can be held personally liable for the carve-outs resulting from acts of misconduct.

Investors should be aware of all choices and ramifications before any decision is considered informed.