We Don't Bite,

We Build Relationships.

Private Real Estate Loans Built on Support, Trust & Transparency

Find out if we’ll be good together.

Free advice. No obligation.

0

+

Years of Experience

0

+

Los Estados Que Se Sirve En

$

0

B+

Operaciones Cerradas Por El Equipo De Gestión

Fast Funding

When time is money, you need speed. Our streamlined approval process delivers hard money loans in just days not weeks. Amplend ensures you get fast funding to close deals quickly and stay competitive in any market.

Flexible Loan Programs

Every investment is different, so we offer flexible loan programs designed for fix-and-flip, rental, and bridge projects. As an experienced hard money lender, Amplend tailors financing to fit your strategy and help your portfolio grow.

No Bank Hassles

Forget the red tape. Our private real estate lending process cuts out the banks and simplifies financing. Enjoy fast approvals, fewer restrictions, and full transparency from a lender that puts investors first.

Local Expertise

As a trusted real estate private lender, Amplend brings local market knowledge and years of experience to every deal. Our deep understanding of regional trends helps investors secure smarter private real estate loans and maximize ROI with confidence.

Investor-Focused

At Amplend, we’re not just funding deals we’re building partnerships. As an investor-focused hard money lender, we provide personalized support, flexible terms, and reliable capital to help you scale your real estate business with confidence.

Dedicated Lending Experts

At Amplend, you’re never on your own. Our experienced hard money lenders and real estate financing specialists provide one-on-one guidance, real-time pricing, and deal analysis to help you make fast, confident investment decisions.

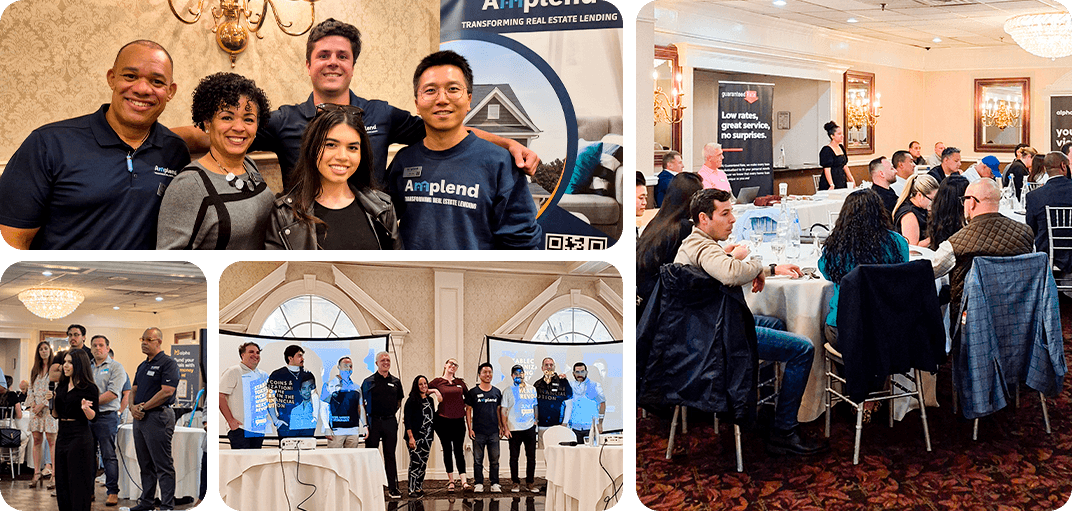

Real Estate Ambition Becomes Action

Supporting Real Estate Investors with Funding, Guidance, and Community.

At Amplend, we know that private lending is more than just numbers, it’s about people, trust, and shared success. That’s why we take a relationship-first approach, offering flexible capital solutions and personal support for real estate investors at every stage.

Whether you're buying your first flip, scaling your portfolio, or somewhere in between, we’re here to provide not just funding, but a real connection you can count on.

We don’t just say we support investors, we show up. From our deal process to our community involvement, we’re proud to walk alongside the people building the future of real estate.

Your next investment deserves hassle-free funding

3 Steps to Success

01

Application

Kickstart your funding journey by submitting a quick and easy online application. Share key details about your real estate project, goals, and financing needs, no mountains of paperwork required. The more we know, the better we can tailor a solution just for you.

02

Approval

Once we receive your application, our in-house team gets to work right away. With no bank bureaucracy or unnecessary delays, we review your deal efficiently and keep you updated every step of the way. Our goal is to move quickly and get you one step closer to funding.

03

Funding

Once approved, you'll receive your funding in just a few days, not weeks. We're committed to helping you move quickly so you can focus on closing deals and scaling your investments.

Donde Prestamos

Amplend Presta En Los Siguientes Estados

Explorar nuestros préstamos, huella, descubrir diversas regiones, y prever bienes raíces, posibilidades. Amplend es su socio en el camino a real estate éxito.

Services

Nuestros Programas De Préstamos

Fix & Flip Loans

Short-term capital for purchasing and renovating properties in New Jersey. Finance up to 90% of the purchase and 100% of rehab costs.

•Perfect for: Renovation projects with quick turnaround

•Loan amounts: $100K – $ 3 M+

•Terms: 6–18 months

Bridge Loans

Short-term capital for purchasing and renovating properties in New Jersey. Finance up to 90% of the purchase and 100% of rehab costs.

•Close in as little as 3–5 business days

•Use for purchases or cash-out refis

•No income verification required

DSCR Rental Loans

For long-term rental property financing based on rental income (not personal income). Ideal for scaling your portfolio.

•Loan amounts: $100K – $3M+

•30-year fixed or ARM options

•DSCR as low as 1.0

New Construction Loans

Building from the ground up? Our private construction loans help you fund land acquisition and development in NJ.

•Up to 85% LTC (Loan-to-Cost)

•Flexible draws with quick disbursement

•Support from blueprint to CO

Being Your Funding Partner is One Thing.

Helping You Succeed is What Matters Most.

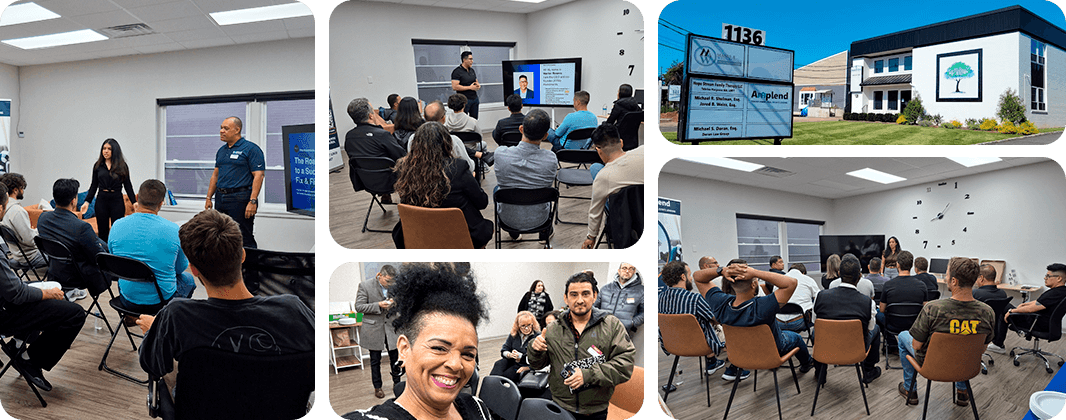

We believe that education and relationships are just as powerful as capital. That’s why we host a Monthly Real Estate Meetup every 3rd Thursday of the month, open to all investors, new or experienced.

These events are packed with insights from seasoned investors, real-life project breakdowns, and networking with people who actually get what you’re doing.

Want to join the next one?

We’d love to have you there. Just RSVP below, it’s 100% free.

Connecting Investors to

Opportunities That Go Beyond Capital.

Amplend is proud to be one of the sponsors of NJRESN, a monthly event dedicated to helping real estate investors connect, learn, and grow together.

Every 2nd Wednesday of the month, investors, developers, lenders, and real estate professionals gather at the New Jersey Real Estate Success Network (NJRESN) to share ideas, expand their knowledge, and form meaningful industry connections.

Want to attend the next NJRESN event?

Reserve your place through the link. It’s worth it!

How we build relationships

Client Testimonials

Gabriel F. & Blanca C.

Gabriel and Blanca, first-time real estate investors, share how Amplend guided them through funding and mentorship for their first fix-and-flip. Reliable support, fast logistics, and a lasting partnership.

Asim K.

A trusted appraisal partner shares why Amplend stands out in the hard money lending space, transparent, honest, and easy to work with. Tei’s full-disclosure approach sets a new standard for lenders in New Jersey and beyond.

Bryson B.

Real estate investor Bryson shares his experience working with Tei on deals in New Jersey and North Carolina. From smooth funding to reliable communication, Tei and his team make financing fast, easy, and personal.

David A.

Real estate investor David Albas shares how Amplend has helped him scale deals quickly using BRRR and fix-and-flip strategies in Harrisburg, PA. Fast, reliable financing that keeps investors moving.

Conocimientos Base

Las recientes Guías en Nuestro Blog

Usted puede leer nuestra calidad superior de las directrices sectoriales y aprender todos los entresijos de préstamos privados proceso. Regularmente, publicamos contenido valioso en nuestro blog para ayudarte a alcanzar tus metas financieras.

EXCELLENTTrustindex verifies that the original source of the review is Google. Amplend ha sido de gran ayuda en nuestro inicio de inversiones.Posted onTrustindex verifies that the original source of the review is Google. Thank you, Amplend, for helping us to get the real estate loans for our properties. Jenny Repko was so supportive of keeping us on track with what we need to do! 100% recommend 👌Posted onTrustindex verifies that the original source of the review is Google. Excelentemente súper bien, confianza al 100 %.Posted onTrustindex verifies that the original source of the review is Google. thank you for your exceptional service and commitment throughout the recent closing process. Your professionalism and dedication truly made a significant difference in ensuring a smooth and successful transaction. I want to express my sincere appreciation for your efforts and for going above and beyond to facilitate a seamless closing. Your expertise and excellent customer service have not gone unnoticed and are genuinely appreciated. I look forward to the opportunity to work with you again in the future.Posted onTrustindex verifies that the original source of the review is Google. I am not one to normally write reviews, but in this case it is more than warranted, after working with other lenders I can see the difference is night, and day. So unfortunately most lenders in the space will offer you the stars, and moon, yet fail to deliver. It is a common practice to bait, and switch, or add some sort of hidden fees in the private lending space. So it was refreshing to work with a company that is transparent, and takes commitments seriously. They offer fast funding, and their team is diligent in their efforts. So normally with this white glove service, you would expect high costs, but they are extremely competitive cost-wise. Their team goes above, and beyond to assist in moving the deal forward. We have closed, various deals with them, and at each one their team has been more then helpful, in routinely following up with all stakeholders, providing advice and resolving any issues. We have a few more deals in the pipeline, and surprisingly their level of customer service has actually improve, which is shocking given the aforementioned. So normally I would not think of a vendor as a partner, but Tei, and his team at Amplend, have been an instrumental partner in scaling our investment business. They are the first call we make once we lock up a deal. We hope to have the privilege to continue to partner with them, as we scale up our business.Posted onTrustindex verifies that the original source of the review is Google. Very transparent during the lending process for real estate investors. Good communication, quick approval, easy to work with.Posted onTrustindex verifies that the original source of the review is Google. Excellent service, 5-star satisfaction. Tei was able to help me to buy my Miami condo. These guys are not expensive, and very transparent with their fees. Strongly recommended. Canadian snowbirds can use Amplend for their US homes.

Colabore con nosotros para hacer crecer su cartera de bienes raíces

No nos conformamos solo para su inmobiliaria prestamista. Si no más bien, nos comprometemos a servir como un confiable parte de su equipo cohesionado, así que usted puede centrarse únicamente en su proyecto con la paz de la mente sobre el financiamiento. Estaremos contigo en cada paso del camino para ayudarle a alcanzar sus metas de inversión.